40 calculating tax math worksheets

Finding the rate of a tax or commission: Worksheets Welcome to the Finding Percents and Percent Equations Worksheets section at Tutorialspoint.com. On this page, you will find worksheets on finding a percentage of a whole number, finding a percentage of a whole number without a calculator: basic & advanced, applying the percent equation, finding a percentage of a total amount: real-world situations, finding a percentage of a total amount ... Tax Worksheets Teaching Resources | Teachers Pay Teachers Reinforce calculating tax and tip and the total bill with this nine question worksheet. Students are given ample space to show their work on the real-world problems. The problems increase in difficulty as the students navigate through the worksheet. Save 20% by purchasing this resource in one of my related bundles.

Income Tax Worksheets Teaching Resources - Teachers Pay Teachers Taxes: Gross & Net Income Budget Calculation Worksheet by Elena Teixeira $1.75 Word Document File This worksheet will take your students through a step-by-step simulation of calculating their net income from a gross income starting point.

Calculating tax math worksheets

Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes Making Change Worksheets | U.S. Money - Math Worksheets 4 Kids Making change worksheets with American bills and coins are a must-have in an elementary lesson plan. Once kids can do basic addition and subtraction, these pdf worksheets come handy in finding the balance amount. Practice handling money, learn to pay with fewest bills and coins, convert from cents to dollars and vice versa, make change with ... Solve system of equations by elimination calculator - softmath Calculating x intercept kid, solve my algebra, free online ti 83 calculator, maths measurements games yr 8, integrated 2 mathematics textbook answers, hard compound inequalities, GCSE maths online print off workbooks. ... , free precalculus solve, free sales tax and discount worksheets for 7th grade math class. Factoring calculator algebraic ...

Calculating tax math worksheets. Common Core Grade 7 Math (Worksheets, Homework, Lesson … EngageNY math 7th grade, grade 7 Eureka, worksheets, Proportional Relationships, Identifying Proportional and Non-Proportional Relationships in Graphs, Unit Rate as the Constant of Proportionality, Common Core Math, by grades, by domains, with video lessons, examples, step-by-step solutions and explanations. Calculating Sales Tax Teaching Resources | Teachers Pay Teachers Students will practice calculating discounts, sales tax and markup with this set of 28 task cards. Use these markup and discount task cards as practice, review or for small group math activities. How to calculate taxes and discounts | Basic Concept ... - Cuemath First, calculate the discounted price. Discount = 30/100 × 12 = $3.6 Final Bill Amount = $12 - $3.6 = $8.4 Remember, the tax is charged at a discounted price. We know that 10% service tax was charged on the final amount. 10/100 × 8.4 = $0.84 Final Amount = $8.4 + $0.84 = $9.24 Different Types of Taxes There are two types of taxes. Quiz & Worksheet - Calculating Payroll Costs | Study.com Test your knowledge of calculating payroll costs with an interactive quiz and printable worksheet. ... overtime is paid at 1.5 that rate. If his tax tax …

Solved: calculate 2022 estimated tax Mar 15, 2022 · Then at the top choose tab "Other Tax Situations". It may ask you if have 3-4 uncommon situations. If so, answer those. Once you get past those, you may then see a screen "Your uncommon Tax Situations" Scroll way down to the last category "Other Tax Forms" and click "Show More." Find topic "Form W-4 and Estimated Taxes" and click Start or Update. Everyday Math Skills Workbooks series - Money Math invisible. But math is present in our world all the time – in the workplace, in our homes, and in our personal lives. You are using math every time you go to the bank, buy something on sale, calculate your wages, calculate GST or a tip. Money Math is one workbook of the Everyday Math Skills series. The other workbooks are: • Kitchen Math Calculating Percentages | How?, Four Ways, Increase, Decrease You can practice calculating percentages by first finding 1% (and/ or finding 10%) and then multiplying to get your final answer using this Calculating Percentages in Two Steps Worksheet. There are also more percentage worksheets here too. Quiz & Worksheet - How to Calculate Property Taxes | Study.com Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000 $18,750 $21,570...

Percentage worksheets and online exercises Percentage worksheets and online activities. Free interactive exercises to practice online or download as pdf to print. ... Live worksheets > English > Math > Percentage Percentage worksheets and online exercises Language: English Subject: Math ... Calculating Total Cost after Sales Tax Grade/level: Grade 5 by mrslewis: 5th-maths-ps05 ... Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers Sales Tax, Tip, and Discount Color-By-Number Worksheet by Eugenia's Learning Tools 13 $2.50 PDF This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Subjects: Markup, discount, and tax - FREE Math Worksheets A lot of "real-life" math deals with percents and money. You will need to know how to figure out the price of something in a store after a discount. You will also need to know how to add tax to your items to make sure you brought enough money! Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Free Worksheet See in a set (11) View answers Add to collection

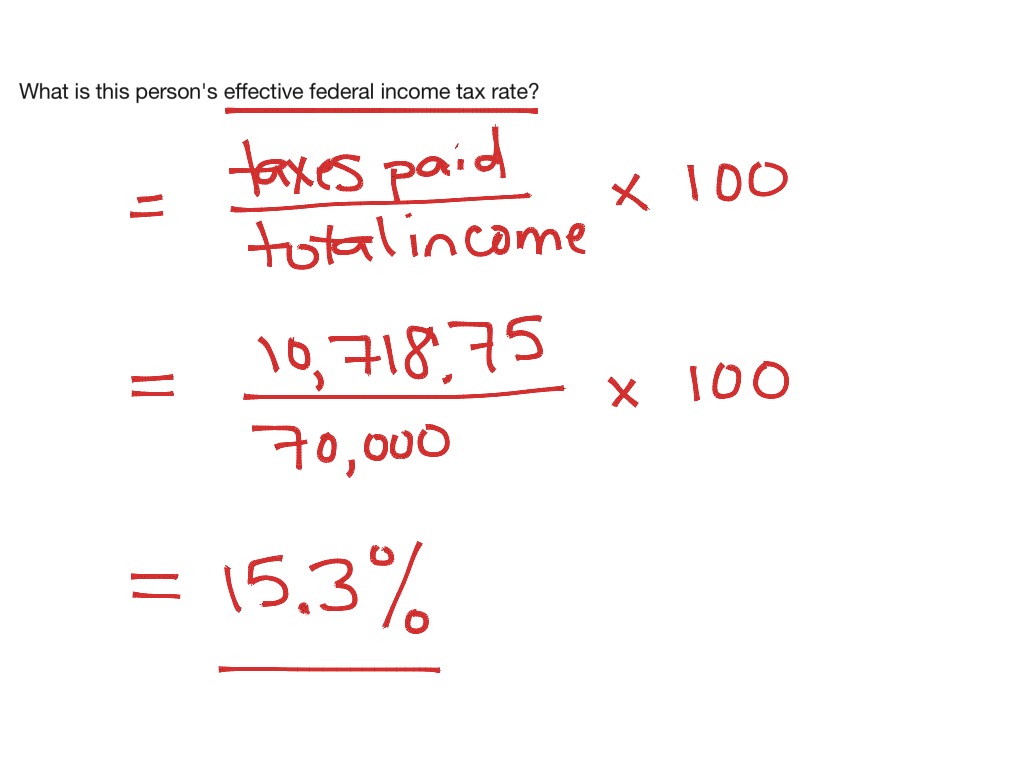

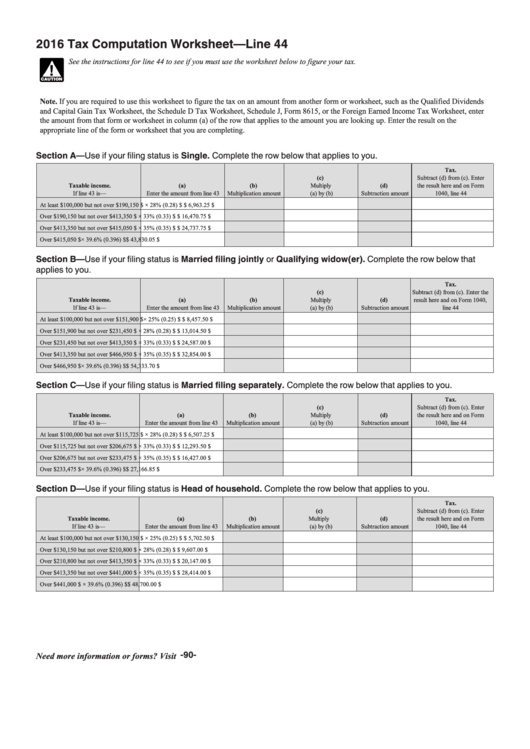

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet The IRS calculated this from the start of the bracket times the rate of the bracket minus the amount of tax actually owed by moving through the lower brackets or in this case $80,250 * 0.22 - $9,234.9 = $8,420.10. So $33,000 minus $8,420 = $24,580 for your tax owed.

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Worksheet Practice Score (__/__) Directions: Solve the following problems on sales tax. Make sure to bubble in your answers below on each page so that you can check your work. Show all of your work! 2 3 4 6 7 1If a table costs $45 and the sales tax is 5%, what is the sales tax? 0.05 Sales Tax = $2.25

PDF Sales Tax and Discount Worksheet Tax: A tax on sales that is paid to the retailer. You need to add the sales tax to the price of the item to find the total amount paid for the item. Procedure: 1.The rate is usually given as a percent. 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price.

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities Use these worksheets, lessons, resources, and activities to help teach your students tax basics. ... A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX. ... Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales ...

PDF Discount, Tax and Tip - Effortless Math Discount, Tax and Tip ... Math Worksheets Name: _____ Date: _____ … So Much More Online! Please visit: EffortlessMath.com Answers Discount, Tax and Tip 1) $530.00 2) $378.00 3) $856.00 5) $262.50 6) $266,250 7) $320.00 8) $127.50 9) $37.50 ...

Capital Gains Tax Calculation Worksheet - The Balance Capital gains are short-term or long-term, depending on how long you owned the assets before selling them. Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another ...

Calculating Tax Worksheet Teaching Resources - Teachers Pay Teachers This resource is great for students who need practice calculating tax, gratuity and discounts from word problems. Problems include scenarios where students are given a total amount of a bill, tax and gratuity percent, and students need to calculate the final amount. Students should know which to calculate first, second, and so on…

Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Worksheet 1. Mary buys a pair of jeans for $24.99, a skirt for $32.99 and a pair of shoes for $49.99. She has a coupon for 15% off the most expensive item. If the tax is 7.5%, what is the total...

PDF Name: Date: Practice: Tax, Tip and Commission 1. Percentsare used to calculate sales tax. 2. Sales tax: A tax put on a good that goes to the government to pay for programs 3. To calculate sales tax, find the tax rateof the price. 4. Then, add the sales tax to the original price. 5. A shirt costs $25.50. If the sales tax rate is 8.5%, what is the total cost to purchase the shirt?

Probability, Statistics, and Data Analysis Activities for Students ... Extra math worksheets can also be found online and used to practice math skills at home, helping you to better understand class materials and even get a head start on upcoming assignments. Use these resources to your advantage and make sure to get the help of a parent or teacher if you’re struggling with probability, statistics, or data ...

PDF Tribal Taxes Math Worksheet - Oregon.gov Tribal Taxes Math Worksheet (Continued) Step 2 Use the information in the table to create a chart representing federal income tax rates by income ranges. Note: Data plot points and line lengths are approximations. Step 3 Use the table and/or chart above to determine the federal income tax rate John would pay on the income he earned last year.

Applying Taxes and Discounts Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount Applying Taxes and Discounts Using Percentages ... Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied.

PDF Calculating the numbers in your paycheck Federal income tax: The federal government collects taxes based on the earnings of individuals and businesses, called an income tax. The federal income tax pays for national programs such as defense, foreign affairs, law enforcement, and interest on the national debt. ° FICA - Federal Insurance Contributions Act: A tax deducted from your pay

Percents Worksheets - Math-Drills Welcome to the Percents math worksheet page where we are 100% committed to providing excellent math worksheets. This page includes Percents worksheets including calculating percentages of a number, percentage rates, and original amounts and percentage increase and decrease worksheets. As you probably know, percents are a special kind of decimal ...

Calculating Total Cost after Sales Tax worksheet Close. Live worksheets > English > Math > Percentage > Calculating Total Cost after Sales Tax. Calculating Total Cost after Sales Tax. Finding Sales Tax and Total Cost after it is applied. ID: 839531. Language: English. School subject: Math. Grade/level: Grade 5. Age: 7-15.

0 Response to "40 calculating tax math worksheets"

Post a Comment